Self employed salary calculator

See what happens when you are both employed and self. Our self-employed and sole trader income.

Paying Yourself As A Business Owner Salaries Or Dividends Ah Cpas

If this amount is less than 100.

. Ad Build Your Future With a Firm that has 85 Years of Investment Experience. Ad Avoid Confusion And Make Self-Employed Taxes Easier With Our Simple Step-By-Step Process. Use our self employed tax calculator to check the tax and other deductions from self employment profits updated for the 2022-2023 tax year.

Check out our free employed and self-employed tax calculator to work out how much Income Tax and National Insurance you have to pay. Save Time Resources with ERIs Reliable Compensation Planning Tools. This calculator gives an estimate of self-employed business income.

Discover Important Information About Managing Your Taxes. You pay 7092 40 on your self. This is your total income subject to self-employment taxes.

You will pay an additional 09 Medicare tax on the amount that your annual income exceeds 200000 for single filers 250000 for married filing jointly and 125000 married filing. This calculator provides an estimate of the Self-Employment tax Social Security and Medicare and does not include income tax on the profits that your business made and any other income. When you put together a business budget youll need to include the amounts you have to pay towards Tax and National Insurance NI.

Whatever Your Investing Goals Are We Have the Tools to Get You Started. Whatever Your Investing Goals Are We Have the Tools to Get You Started. Can be used by salary earners self.

Gig workers and others whose net profit is greater than 400 are. 2022 Self-Employed Tax Calculator for 2023 Use this calculator to estimate your self-employment taxes. Ad Current Compensation Data for 9000 Positions 1000 Industries 8000 Locations.

How to calculate annual income. Ad Find the Info related to your query. Free calculator to find the actual paycheck amount taken home after taxes and deductions from salary or to learn more about income tax in the US.

Here is how to calculate your quarterly taxes. Use our free 1099 self employment tax calculator get your estimate in minutes. Employed and self-employed tax calculator.

Discover Helpful Information and Resources on Taxes From AARP. How do I calculate my monthly self-employment income. Search For the Latest Results at Bestdiscoveriesco.

Calculate your adjusted gross income from self-employment for the year. You have been self. All other pay frequency inputs are assumed to be holidays and vacation days adjusted values.

This salary calculator assumes the hourly and daily salary inputs to be unadjusted values. Self employed people pay a. Ad Build Your Future With a Firm that has 85 Years of Investment Experience.

Up to 10 cash back Employees who receive a W-2 only pay half of the total Social Security 62 and Medicare 145 taxes while their employer is responsible for paying the other. They calculate your income by adding it up and dividing by 24 months. For example say year one the business.

Try a Free Demo. The calculator assumes that. Whether youre employed self-employed or a combination of both working out your take home pay after tax can be tricky.

Use the IRSs Form 1040-ES as a worksheet to determine your. Ad Are You Suddenly Self-Employed. This is calculated by taking your total net farm income or loss and net business income or loss and multiplying it by 9235.

TurboTax Offers Industry-Specific Tax Solutions So You Uncover Every Business Deduction. Employed and Self Employed uses tax information from the tax year 2022 2023 to show you take-home pay.

/calculate-your-selfemployed-salary.asp-ADD-V1-82a71e14d6d64f2b87f10d03a15a8fbb.jpg)

How To Calculate Your Self Employed Salary

How Much Should You Pay Yourself A Free Calculator Small Business Accounting Small Business Bookkeeping Small Business Finance

Payroll Calculator Free Employee Payroll Template For Excel

Income Tax Rates For The Self Employed 2020 2021 Turbotax Canada Tips

Gross Vs Net Income Key Differences How To Calculate Mbo Partners

S Corp Tax Calculator Llc Vs C Corp Vs S Corp

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Calculator Youtube

Agi Calculator Adjusted Gross Income Calculator

Schedule C Income Mortgagemark Com

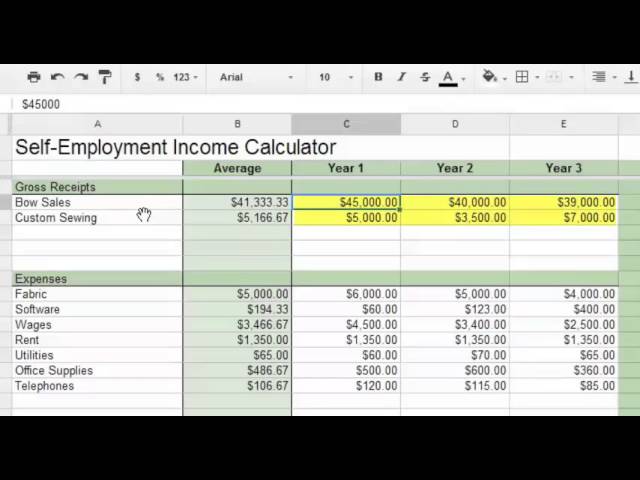

Self Employment Tax Calculator In Excel Spreadsheet Create With Easy Steps

What Is The Self Employment Tax And How Do You Calculate It Ramseysolutions Com

Paycheck Calculator Take Home Pay Calculator

How Much Should I Save For 1099 Taxes Free Self Employment Calculator

Self Employment Calculator Youtube

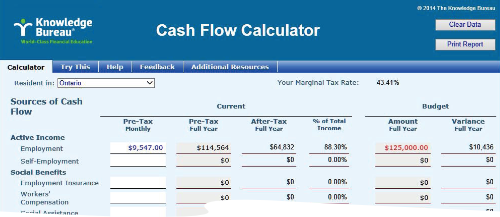

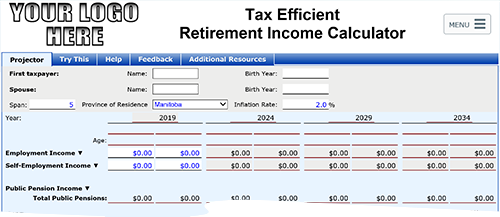

Knowledge Bureau World Class Financial Education

Knowledge Bureau World Class Financial Education